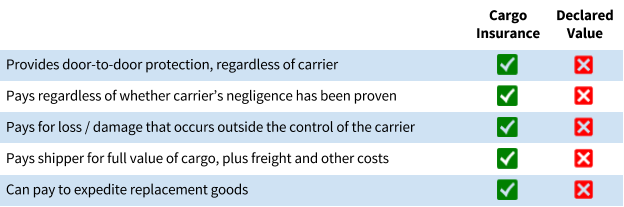

Declared value coverage is not insurance, it raises the carrier’s financial liability. See below for more details, and for the advantages of cargo insurance vs. declared value coverage.

What is declared value coverage?

Declared value coverage is a form of cargo damage/loss coverage that raises the carrier’s financial liability so that it matches the declared value of the cargo. Declared value coverage is not cargo insurance.

Declared value coverage is limited to the period of time when the cargo is in possession of a single carrier, and it only kicks in if damage or loss occurred due to the carrier’s negligence. It is the responsibility of the shipper to prove that the carrier was negligent.

What are the advantages of cargo insurance vs. declared value coverage?

Declared value coverage is often subject to deductibles, exclusions, warranties, and policy limits that are not made clear to the shipper. Common exclusions that would result in declared value coverage not being paid out include:

- “Dishonesty on the part of carrier’s employees”

- “Theft occuring while the vehicle is left unattended”

- “Theft of certain commodities such as cell phones, cigarettes, fashion apparel, computer memory, and the like”

- “Acts of God”

Cargo insurance, however, covers a shipment throughout its journey from pickup to delivery across multiple carriers and modes, regardless of whether or not the loss/damage was because of any carrier’s negligence.