A Commercial Invoice is a document used for Customs declaration, along with the Packing List

What is a Commercial Invoice?

A commercial invoice is a document used for customs declaration that identifies the value and quantity of the shipped products.

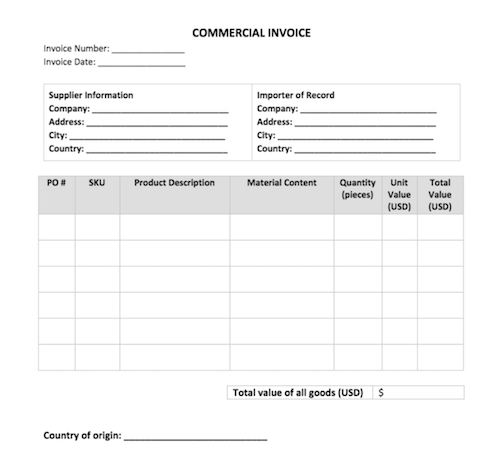

What must be included in a Commercial Invoice?

- Country of origin / manufacture (where the products were made)

- Full name and address of the **supplier / manufacturer **

- Full name and address of the business or person buying the products (noting if this person or business is different from the importer)

- Full name and address of the **person or business to whom the goods are being shipped **

- Quantity of units for each product

- Unit value for each product (both in US dollars and the supplier’s currency)

- Note: a declared value for every product imported is required, so a $0 value is not acceptable for Custom purposes. We suggest the fair market value of the product to be declared, even if you are receiving the goods free of charge.

- A complete description of the product that includes: what the product is, what the product is used for, and what the product is made of

Note: A SKU is not a product description.