HS and HTS codes are for Customs product classification.

What are HS codes?

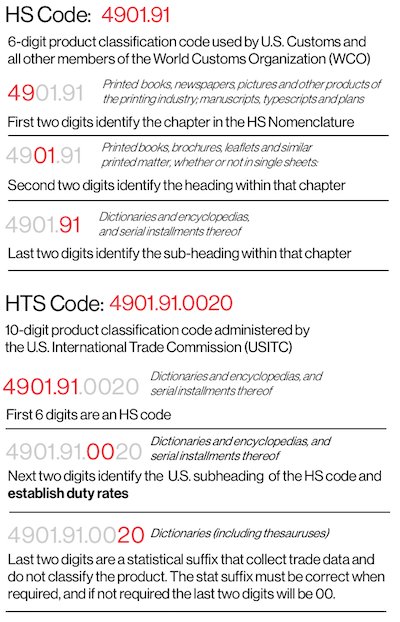

HS (Harmonized Commodity Description and Coding System) codes are product classification codes used by U.S. Customs and all other members of the World Customs Organization (WCO) to classify goods for customs purposes.

HS codes are six digits that can be broken down into three parts: the first two digits identify the chapter in the HS Nomenclature the goods are classified in, the next two digits identify the heading within that chapter, and the last two digits identify the subheading within that chapter.

The U.S. uses HTS codes to classify products imported into the U.S.

What are HTS codes?

HTS (Harmonized Tariff Schedule) codes are product classification codes between 8-10 digits. The first six digits are an HS code, and the countries of import assign the subsequent digits to provide additional classification. U.S. HTS codes are 10 digits and are administered by the U.S. International Trade Commission.

Your supplier may be able to provide you with an HTS code, but note that many Chinese suppliers will supply the Chinese variation of the HTS code. Since the first six digits of an HTS code is a universal HS code, you need to determine the final four digits of the HTS code for U.S. import using the Harmonized Tariff Schedule. With an HTS code, you can estimate the customs duties you will need to pay upon importing into the U.S.

See How Do I Know the HTS Code of My Product? for more information on how to determine an HTS code for U.S. imports.